ev charger tax credit form

In this article we will go over ways to save on installing an electric vehicle charger what EV rebate program you might be eligible for and how these. All tax credits apply to the income taxes that you file for the previous year.

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs.

. Rebates are cash incentives provided by utilities or municipalities based on first come first serve availability. The charging station must be purchased. Putting electric vehicle EV charging stations at your commercial property or home is a good investment opportunity especially given the tax credits and incentives available to you.

Its subject to TMT whereas other credits like The EV car credit and Solar credits arent. The Vehicle Conversion to Alternative Fuel and the Electric Vehicle Charger tax credits are still available. Best of all the TOG EV700 is eligible for Federal.

If your business has multiple locations you can. Of course all of this adds up to 12k so Im trying to figure out how to get the EV and EVSE credits to apply first followed by the solar credit since I understand the solar credit can carry over to next year whereas the other credits cant. The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations.

The EV tax credit is 7500 the EVSE credit on our station is 1000 and our solar credit is 8800. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. But Uncle Sam is not the only.

Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive. Qualifications for the Vehicle Conversion to Alternative Fuels or Electric Vehicle Charger Tax Credits.

Tax credits are available for EV charger hardware and installation costs. Previously this federal tax credit expired on December 31 2017 but is now extended through December 31 2021. And while it is a non-refundable credit ie.

Rebates and tax incentives vary. It covers 30 of the cost for equipment and installation up to 30000. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station.

Figured it out. Just buy and install by December 31 2021 then claim the credit on your federal tax return. Install costs can account for the majority of the total cost of installing EV charging especially for commercial installations.

Jan 26 2022 12452 PM. A Level 2 charger like the TurnOnGreen EV700 is ideal for home charging as it can fully charge any EV model overnight. Grab IRS form 8911 or use our handy guide to get your credit.

Credits on Form 1040 1040-SR or 1040-NR line 19 and Schedule 3 Form 1040 lines 2 through 5 and 7 reduced by any general business credit reported on line 6a any credit for prior year minimum tax reported on line 6b or any credit to holders of tax credit bonds reported on line 6k. In other words costs of 100000 per location are eligible for the credit potentially yielding a combined credit far in excess of 30000 for taxpayers who installed commercial chargers at multiple locations. It cannot be used to increase your overall tax refund it is still a.

This incentive covers 30 of the cost with a maximum credit of up to. For residential property 1000 is closer to an absolute cap because a taxpayer can have only one primary residence. For residential installations the IRS caps the tax credit at 1000.

If you purchased your EV more than 3 years ago and the vehicle is still eligible for the tax credit you can file an amended return to. Level 1 chargers are provided with the purchase of most electric vehicles. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

Use this form to figure your credit for alternative fuel vehicle refueling property you. Electric vehicle chargers - 10 of the cost of the charger and its installation or 2500 whichever is less. Basically if you have enough credits for the year even if you still have tax liability and no AMT your TMT will dictate if you will get the EV Charger credit.

Learn more about how to claim your electric vehicle credits and potentially save thousands of dollars on Tax Day. Form 1041 Schedule G. Form 6251 is for AMT and is has the calculated TMT or Tentative Minimum Tax.

A Level 1 charger plugs into any electrical outlet and can take days to fully charge your vehicle. We try to maintain this page regularly but another resource that may be helpful in finding additional Federal and State EVSE incentives is the US. This importantly covers both components on charging costs.

You feel the effect when you file a tax return in the form of a reduced payment or a larger refund. The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit. This federal EV infrastructure tax credit will offset up to 30 of the total costs of purchase and installation of EV equipment up to a maximum of 30000 for commercial property and 1000 for a primary residence.

The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. Please see our top summary of electric vehicle incentives by state. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations.

And its retroactive so you can still apply for installs made as early as 2017. 30 tax credit up to 1000 for residential and 30000 for commercial. Enter 100 unless the vehicle was manufactured by Tesla or General Motors Chevrolet Bolt EV etc To claim your federal EV tax credit you must fill out Form 8936 along with Form 1040.

IRS Form 8911 and it provides a tax credit of 30 up to 1000 of the purchase and installation cost of. Enter the total of any write-in. Up to 1000 Back for Home Charging.

Department of Energy Alternative Fuel Data Center. By filling out Form 8936 at the same time that you file your federal tax returns you can qualify for up to 7500 in tax credit earnings. The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations.

You use form. Since installation costs are significant for EV chargers this rule. It applies to installs dating back to January 1 2017 and has been extended through December 31 2021.

For tax years beginning before January 1 2020 a tax credit is available for up to 75 of the cost of installing commercial alternative fueling infrastructure. Unlike some other tax credits this program covers both EV charger hardware AND installation costs. Tax credits apply to a given year.

Solar Panels And Ev Stations Solar Powered Charging Freedom Solar

How To Claim An Electric Vehicle Tax Credit Enel X

Featured Design Strategy Work Design Strategy Supermarket Design Parking Design

Residential Charging Station Tax Credit Evocharge

Rebates And Tax Credits For Electric Vehicle Charging Stations

Blink Ecotality By Frog Design Machine Design Id Design Ev Chargers

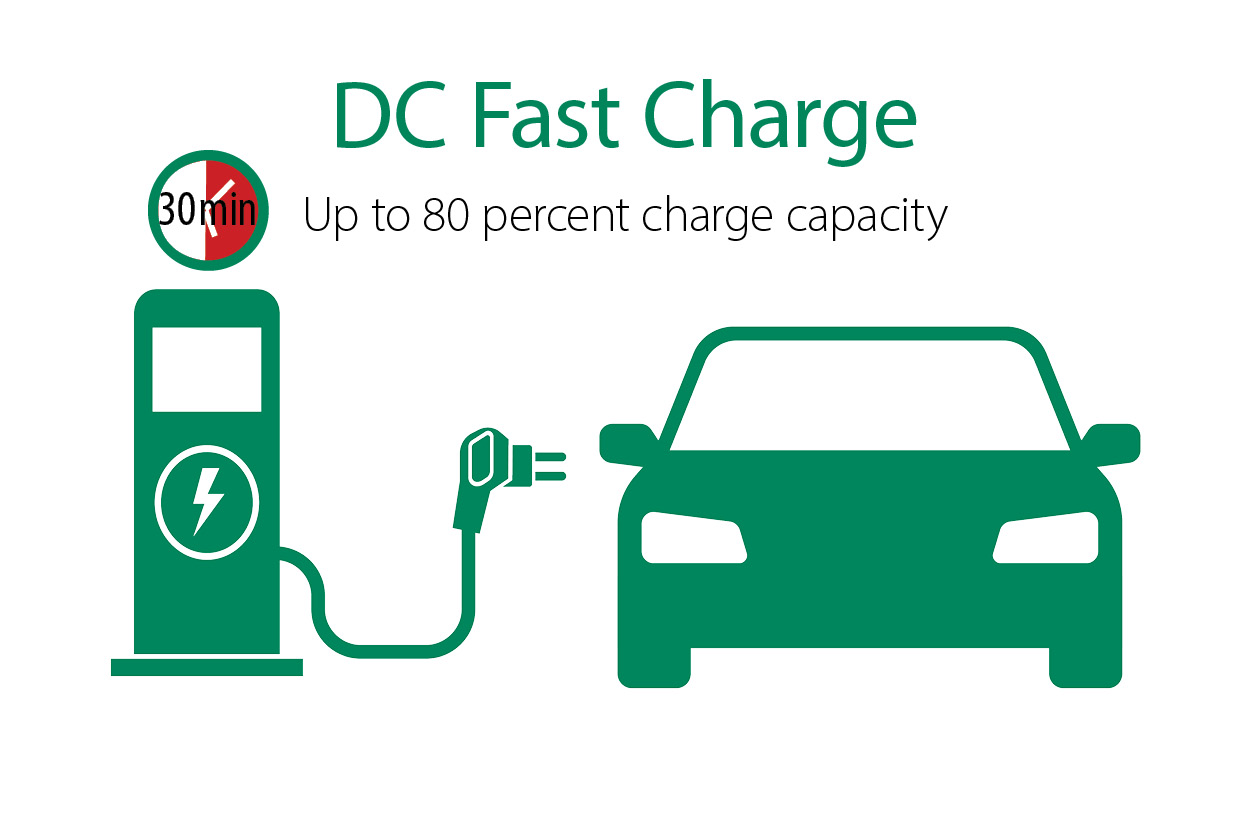

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Tax Credit For Electric Vehicle Chargers Enel X

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Can I Get A Tax Credit For An Ev Charger In New York Roy S Roy S Plumbing Heating Cooling

Uk Unveils Extensive New Plan To Go All Electric By 2040 Last Year The Electric Car Charging Electric Vehicle Charging Electric Vehicle Charging Station

Fuseproject Product Ge Wattstation Electric Car Charger Ev Charger Charger Car

About Electric Vehicle Charging Efficiency Maine

Home Charging For E Mobility Designed By Kiska On Behance Station De Charge Electronics Projects Voiture Electrique

Electric Vehicle Charger Installation

Commercial Ev Charging Incentives In 2022 Revision Energy

Guide To Home Ev Charging Incentives In The United States Evolve