ny highway use tax rates

The highway use tax HUT is imposed on motor carriers operating motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. See Tax Bulletin An Introducti.

Florida Car Sales Tax Everything You Need To Know

As a carrier operating certain motor vehicles on the New York State public highways you are subject to the New York State Highway Use Tax Law.

. IFTA-1051 322 Not applicable. IFTA Final Use Tax Rate. The highway use tax is computed by multiplying the number of miles traveled on New York State public highways excluding toll-paid portions of the New York State Thruway by a tax rate.

Our agents process all documentation carefully and effectively. Highway Use Tax and Other New York State Taxes for Carriers Publication 538 708 Publication 538 708 1. When completing your first return for the calendar year you must choose to.

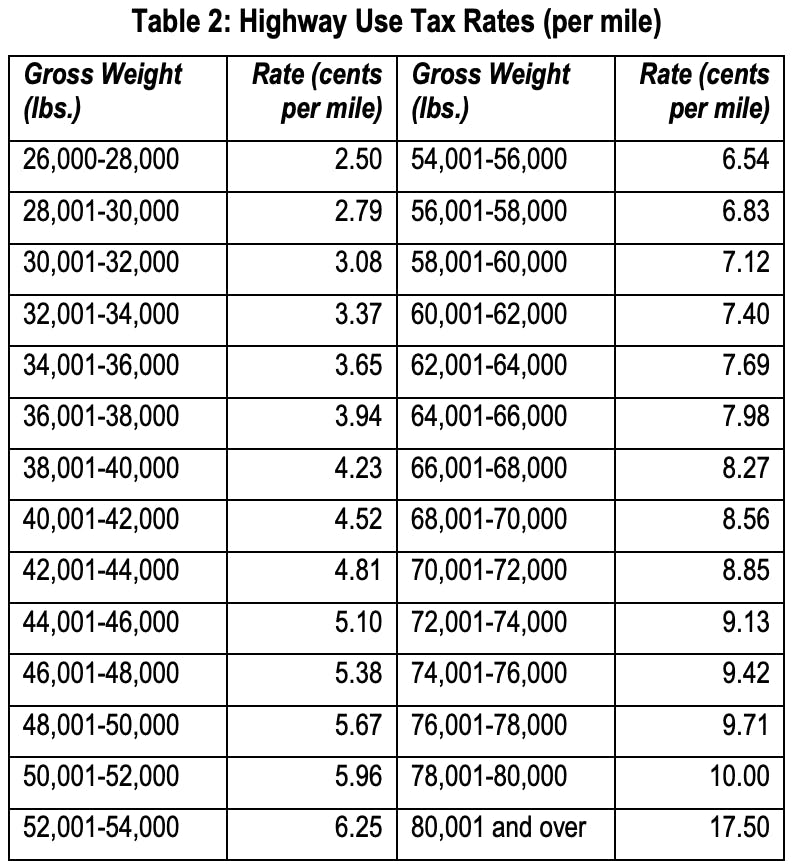

The tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax. Tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax. To download publications forms and instructions and to obtain information updates on New York State tax matters visit our Web site wwwtaxnygov.

New york highway use tax hut permit is required for vehicles over 18000 pounds traveling on new york public highways. The New York use tax should be paid for items bought tax-free over the internet bought while traveling or transported into New York from a state with a lower sales tax rate. The second option is to file your HUT tax return by mail.

You can conduct a standard Web File. Increasing interest rates and will avoid civil enforcement actions including tax warrants levies income executions and seizure and sale of assets. 888 669-4383 888 NOW-GETDOT.

In general the gross weight method is used to compute your tax and. The tax rate is based on the weight of the vehicle and the method that you choose to report the tax. At a rate determined by the weight of the motor vehicle and the method that you choose to report the tax.

Trucking Association of New York supports full repeal of New Yorks Highway Use Tax HUT to reduce the tax burden faced by these companies. New York imposes a Highway Use Tax HUT on any motor carrier using New York highways with a gross vehicle weight over 18000 pounds. IFTA-1051 922 Not applicable.

If you do not comply with the Highway Use Tax Law you may be subject to civil or criminal penalties. Highway use tax returns may be filed either by. Questions about a New York Highway Use Tax Permit or New York IFTA.

IFTA Final Use Tax Rate and Rate Code Table 2. If you have any questions please see need help. You can find this number on the TMT-7 and TMT-71 Highway Use Tax HUT andor Automotive Fuel Carrier AFC Certificate of Registration.

Thats how most New York State carriers file HUT tax returns. The new york use tax rate is 4 the same as the regular new york sales tax. You can file a.

You operate a motor vehicle as defined in Tax Law Article 21 in New York State. To Web File youre required to report the current certificate number for every vehicle you need to report mileage on. IFTA Final Use Tax Rate and Rate Code Table 2.

The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor vehicle and the method that you. Using Web File. Rate Sheet for IFTA Packet - 2nd Quarter 2022.

The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor vehicle and the. A study conducted in. Form MT-903 is.

Call Benjamin Goldman Law Office at 518-660-1950 - A speeding ticket traffic attorney in NY. For assistance calculating highway use tax see Tax Bulletin How to Determine Your. Using our services you will receive the required permit license and application as easy and soon as possible.

The New York use tax rate is 4 the same as the regular New York sales tax. Highway Use Tax and Other New York State Taxes for Carriers Publication 538 812 Publication 538. The highway use tax is computed by multiplying the number of miles traveled on New York State public highways excluding toll-paid portions of the New York State Thruway by a tax rate.

To register fill out Form TMT-1 or use their online registration system. For more information see Tax Bulletin Summary of Enforcement Provisions Highway Use Tax TB-HU. What is the highway use tax and how is it calculated.

We provide a full-range registration service for your business. For information regarding highway use tax see Tax Bulletin An Introduction to Highway Use Tax TB-HU-40. Points Reduced Or Your Money Back.

Including local taxes the New York use tax can be as high as 4875. Read about the HVUT at the web site of the US Internal Revenue Service or. Contact DOT Operating Authority with any questions you might have.

There are two options for filing a New York State highway use tax return. Federal law requires proof that the HVUT tax was paid when you register a vehicle that has a combination or loaded gross vehicle weight of 55000 pounds or more. These carriers are required to register and obtain a New York HUT certificate and decal.

New York State Highway Use Tax TMT is imposed on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. Rate Sheet for IFTA Packet - 3rd Quarter 2022. The Federal Heavy Vehicle Use Tax HVUT is required and administered by the Internal Revenue Service IRS.

York based motor carriers may opt to simply not report miles in New York. 18 rows IFTA Final Use Tax Rate and Rate Code Table 2 - 1st Quarter 2022. New York State imposes a highway use tax HUT on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway.

You also cant use HUT Web File to add vehicles onto or to cancel. New York imposes a highway use tax NY HUT or New York Highway Use Tax on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. Click Edit Rates.

Traveled on New York State public highways and is computed at a rate. The tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax. IFTA-105 922 Not applicable.

IFTA-1051 622 Not applicable.

Judge Overturns Irs On Artist Tax Deductions Irs Tax Deductions Internal Revenue Service

Ny Highway Use Tax Hut Explained Youtube

Many Factors Go Into Retirement Decisions This Article Examines Many Of Those Factors Such As Where To Retire Estate Planning Debt Management Reality Check

Car Moving On A Bridge New York City Stock Footage Bridge Moving Car York Stock Footage New York City Move Car

I 25 Toll Lane Proposal Between Castle Rock And Monument Might Ease Traffic Jams But It S Inflaming Anti Tax Passions Castle Rock Monument Castle

Beautiful Facts About New York City New York City Backyard Landscaping Evergreen Vines

There Have Been No Breaches Or Hacking Of Customer Data At Txtag That We Know Of Txdot Contracts With Conduent State Local S Contractors Compliance Security

Pacific Coast Highway Santa Monica Lkg S 1968 California Travel Road Trips Pacific Coast Highway Los Angeles History

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Amazon Had Sales Income Of 44bn In Europe In 2020 But Paid No Corporation Tax The Guardian Corporate Corporate Tax Rate Amazon Prime Day

This Bar Graph Breaks Down Total Federal Income Tax Revenues By The Earnings Percentiles Of The Americans Who Paid Them Federal Income Tax Income Tax Day

Ny Hut Permits Ny Hut Sticker J J Keller Permit Service

Ata Ooida Decry Connecticut S New Vehicle Miles Traveled Truck Tax Commercial Carrier Journal

10 Best Insurance Broker In New York City Video Insurance Broker Best Insurance Insurance

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

14948 County Highway 17 Roscoe Ny 12776 Mls 126582 Zillow Roscoe Zillow Party Barn